Looking outside of your home country for an investment property is a great way to diversify your portfolio. Foreign investment reduces your reliance on one country’s economic and political circumstances and in some cases, opens up a world of opportunity. This is especially true when it comes to vacation rentals, which can generate a promising amount of cash flow for a keen investor.

If you’ve ever considered an investment property in Mexico, look into the popular tourist destination, Puerto Vallarta, which aside from being a beautiful place has also become a great place for foreign investment in recent years. One big reason is the attractive oceanside resort city draws millions of annual visitors from all over the world, making it a cash cow in the world of short-term rentals.

In 2022, the Puerto Vallarta international airport broke records, receiving over 6.2 million passengers. This is projected to continue rising, prompting an expansion of the airport, which started in August of 2022. In addition, a highway has been constructed between Guadalajara and Puerto Vallarta to optimize direct road traffic between the two destinations, and just 20 minutes north of PV, La Cruz de Huanaxactle boasts Mexico’s most sophisticated and developed Marina. These infrastructural advancements continue to ensure that Mexico’s beloved resort city is easily accessible to national and international tourists year-round by air, by land, and by sea.

While in Mexico, hotels currently average an occupancy rate of 59%, Puerto Vallarta boasts 86%, officially leading the country as the top tourist destination in Mexico, surpassing Cancun and Los Cabos. This shows a lot of promise for short-term rental revenue in a region where real estate prices are still much more accessible than their US counterparts, with median sales prices in the condo category at $334k USD. (Flex MLS)

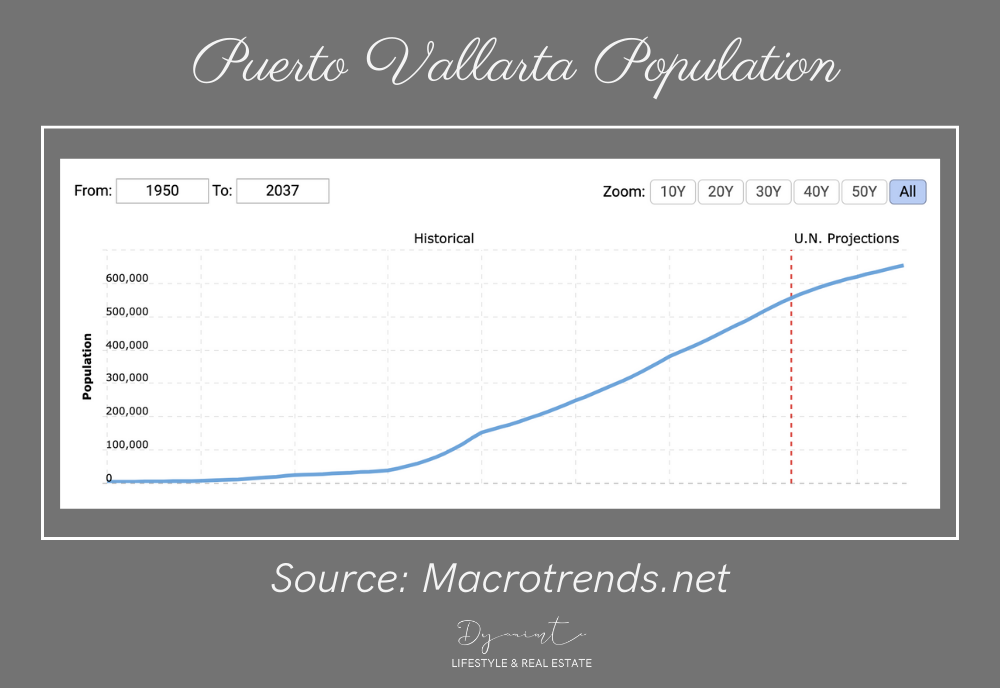

The blossoming tourism industry has, of course, attracted many businesses, creating jobs, and drawing more and more people to move to PV permanently. Puerto Vallarta’s population is currently over 550k and projected to rise to 654k by 2037 (chart below):

Developers are scrambling to create inventory to accommodate the growing population and the growing demand for national and international accommodation. Out of 3,841 condos sold in the last 3 years in PV & Banderas Bay, 2,374 were new condos sold in the pre-construction phase, an astonishing majority of 62%. As more and more high-rises emerge, property value is appreciating exponentially and the real estate market in the region continues to thrive.

Most foreign investors are also incentivized by the perk of utilizing their investment property in Mexico as a vacation home for themselves and their families for a portion of the year where they can look forward to beautiful scenery, tourist attractions, and beautiful architecture while generating extra income. Who doesn’t want an investment that ties them to a tropical getaway? After all, there have been worse tasks than a quick flight to Puerto Vallarta to sign some documents or handle some business.

Puerto Vallarta continues to draw in Americans. In 2022, more people immigrated from the United States to Puerto Vallarta, Mexico as permanent residents than ever before. Additionally, American investors account for 40% of home ownership in Puerto Vallarta, more than any other group. Whether you are considering relocating to Mexico full-time, or are interested in a long-distance investment property that can double as a vacation home, this article covers some essential tips to save you money in the long term.

In terms of real estate investment, risk comes with the territory, but the end game is always long-term gain. Every investor wants to rest assured they will see both a return of and a return on their capital investment. So how do you assess the details of this return with your potential investment property in Mexico, especially if the concept is new to you?

In order to compile this list of 8 Ways to Maximize Your Mexico Investment Property Returns, we’ve analyzed the financial details of a variety of real estate transactions in Puerto Vallarta, Mexico in recent years taking into account cap rates, cash-on-cash rates of return, and the perspective of US-based investors. Some of these follow the general rule of thumb in investment strategies, and some are specific to the region of Puerto Vallarta, Mexico. Whether you’re a novice investor or have been in the game for a while, all of these are important things to keep in mind.

Please note, the calculations and estimates presented in this article are based on past indicators and do not guarantee future results.

1. Decide in advance: Presale or Resale?

Real estate investors have varying objectives and available liquidity which directly impacts each individual’s strategy. Because the condominium market in Puerto Vallarta is dominated by developments in the preconstruction phase, which are sold directly by the developer at discounted rates, many investors choose this type of construction for their PV property purchase.

There are several perks to buying presale. One prominent one is the reduced price. Developers rely on a portion of presale transactions to produce cash flow to fund the construction process, so these purchases are incentivized with reduced listing prices and large discounts relative to the percentage of cash put down. In addition, many developers offer short-term financing options which give you the opportunity to pay in phases until the property is completed. Read 9 Benefits of Buying Pre-Construction Condos in Puerto Vallarta for more perks on presale advantages.

However, most financial institutions will not directly finance anything in the preconstruction phase, which can complicate the investment process, tying up a chunk of your cash in the purchase of one property.

Purchasing an already constructed property from an individual (resale) is a also great investment if you would prefer to seek financing, and your goal is to generate rental income to pay off the debt allowance and ultimately see a higher cash-on-cash rate of return.

So, which option is best for you?

If you are a wholesale real estate investor interested in capital gains sooner than later, buying at an early stage in pre-construction with cash is where you will see the highest cap rate. If you are willing to sit on your property for a couple of years and re-sell it when it reaches a higher value (see reason #8 in this article), it is very likely you will see returns while paying less in the lifetime of your investment. Without mortgage payments deducted from your rental income, your cash flow is immediately available to you as well.

However, if you are interested in long-term planning, such as retirement, and you have $300k in cash to spend, consider your options. Instead of purchasing one presale unit at $300k, you could potentially buy two properties worth $375k with two down payments of $150k. These are also likely to come furnished, reducing your initial investment and increasing your cash-on-cash rate of return.

2. Explore Your Financing Options

So what kind of financing options are available to a foreigner to Mexico?

1️⃣ Finance at home & come with liquidity

People generally do this through a variety of methods: a home equity loan, a second mortgage on your property or properties, or a retirement fund to name a few. The primary perk to this is the interest rate will most likely be preferable to that of a Mexican bank, and you will qualify for cash incentives that are offered by developers.

2️⃣ Find an investment partner or partners

Using other people’s money is a great way to gain leverage in your investment strategy. Additionally, the vacation property component and the popular location may spark interest among friends and colleagues. You and your investment partners can black out the dates you plan on vacationing in your investment property and rent it out as a vacation rental for the rest of the year. This, of course, divides the pie of your cash flow and gains but can raise your budget significantly and enable you to invest in the properties with the highest returns, which tend to be the higher-priced ones.

3️⃣ Get a mortgage from a Mexico bank

Mexico financial institutions offer several mortgage packages as well as refinancing opportunities to foreigners and nationals for their Mexico property purchases. Talk to your real estate agent to help you find a program that works for you. To get an idea of basic costs, I spoke to Joshua Rappaport, a Canadian who runs Cross Border Investment CBI, based in Puerto Vallarta, Mexico. Josh has been facilitating mortgages for Americans, Canadians, and other foreigners to Mexico since 2011. He said as some broad guidelines for your financial planning, expect interest rates that range from 8%-12% and payback periods of up to 30 years. Josh also advises against pursuing pre-construction financing opportunities from banks. “Banks do not finance pre-construction,” he says. “For there to be a mortgage on a property the property needs to be constructed and have the paperwork to deed. What some mortgage brokers do is take applications at any point, approve the client but the loan itself won’t fund until the property can be deeded.”

4️⃣ Seek owner-based financing

The details of these options fluctuates, but this is always an alternative option to explore. You or your agent can set a filter in the MLS to see what kind of options may exist for this. Many developers also offer their own financing, giving you the opportunity to pay in phases over the course of several months or even years.

3. Pick your region strategically

If you’re looking for immediate cash flow, consider a safer investment in a more established region. However, if you’re willing to wait, check out some of the emerging areas. Examine market trends to locate the best places to invest. Already established areas such as the Romantic Zone of Puerto Vallarta, and Bucerias in Nayarit have a higher buy-in but offer higher short-term rental revenues. Emerging areas such as 5 de Diciembre, Fluvial & Versalles in Puerto Vallarta, and Nuevo Nayarit & La Cruz de Huanaxactle are all experiencing promising growth. The buy-in is lower but so is the cash flow. The appreciation rate, however, could be higher in some of these zones. Talk to your real estate agent about the pros and cons of each region prior to purchase. Take into account risk factors, accommodation of pedestrians for vacation rental attractibility, infrastructure plans in store, and of course property prices to arrive at the best option for you.

4. Choose your unit wisely

This is where some investors who are also looking to utilize their property as a vacation home may need to make some personal choices. Some things benefit the homeowner and carry an extra cost, but do not have much impact on short-term rental revenues. A prime example of this is the floor your unit is on. Developers incentivize lower-floor buy-ins with lower costs because they will build them and deliver them first. It’s an effective strategy because the lower floors don’t have as favorable views as the upper-level ones, so people are willing to pay more for the higher floors. While views can impact the marketability of your vacation rental, keep in mind that the best views are usually from the common area /pool which is usually on an upper-level deck or the roof of the condominium complex. All tenants have access to these areas, so photos of them can be incorporated into your marketing materials. Spending hundreds of thousands of dollars more for a unit with a better view on an upper floor may not make much of a difference in the marketability and potential revenue of your vacation rental.

5. Project the net revenue of your property

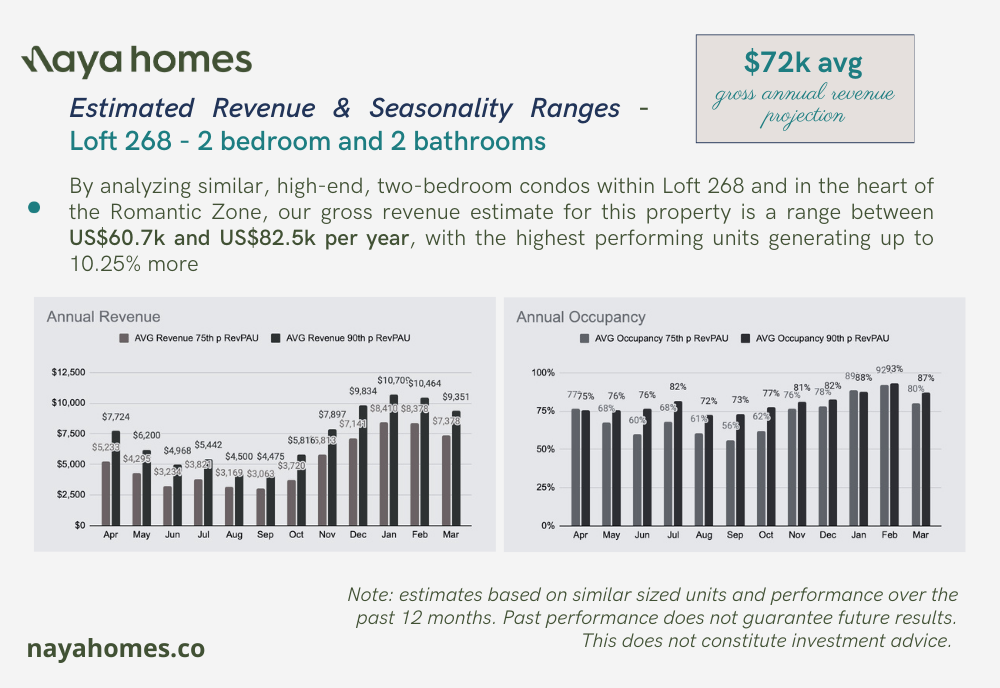

I spoke with Humberto Pacheco, CEO of Naya Homes, a property management company with operations in Puerto Vallarta and Mexico City. They have a system for gross revenue projections, which they offer to homebuyers to help them determine the return on their investment prior to purchase. “You’d be surprised how much projections can vary in different regions, and how things such as the number of bedrooms can make a huge difference in the potential income of a specific unit,” Humberto says. “We tend to manage units in the top buildings, which tend to be the ones guests like to stay at the most. There are many in the Romantic Zone, some in Hotel Zone, and in Nuevo Nayarit and Bucerias, we currently only take units close to the beach.”

Naya Homes provided us with the gross revenue projection of a 2 bed/ 2 bath condo in sample property Loft 268, a development located in the heart of Romantic Zone which came to $72k/year, as an average of the estimate range.

Minus

⛔ Property Management: $18,360

If you choose to go with a property management company such as Naya Homes, they charge a commission of 20% of revenue income plus a fixed monthly fee of $150. “Make sure to put an additional 3% of your rental income aside for repairs and capital expenditures,” Humberto advises. Utilizing the average estimate of gross revenue at $72k, these percentages and fixed fees come to $18,360/year.

⛔ Operational Expenses: $11,020

I spoke with a homeowner of a 2 bedroom/ 2 bath condo in Loft 268 who provided me with a summary of annual operational expenses:

-

-

Utilities: $3500k

-

HOA: $5520/year ($460/mo)

-

Property Taxes: $1500

-

Fiedocomiso (Trust) annual fee: $500

-

-

= Net Annual Revenue: $42,920

6. Estimate all costs associated with your purchase

This goes without saying, but many times real estate agents will be hesitant to provide you with projections or exact details of your possible transaction costs due to the unique financial circumstances that surround individual transactions. No one can tell you for sure what all of the costs are until you put the plan into play and authorized legal and financial specialists sum up the details. However, taking notes on all of the potential expenses associated with each transaction can prevent you from being sidelined by unforeseen expenses. When you overestimate your transaction costs, you ensure you have the capital to cover them. For a quick ballpark estimate of all costs associated with the transaction of purchasing a property in Puerto Vallarta, Mexico.

⛔ Closing Costs:

If you are paying in cash, account for 6% of the purchase price in additional cash to cover closing costs. Keep in mind some of these will be deductible from the capital gains tax when you eventually choose to sell your property, so keep all of your records. If you will be financing your purchase, there are additional closing costs associated with the mortgage that add up to 4 % of the purchase price. In this case, tack on 10% of your total.

⛔ Investments:

Pay close attention to any potential infrastructural investments your property may require to meet your needs or the needs of your tenants. Are there enough electrical outlets? How is the plumbing? Are there enough ceiling fans? How is the lighting? Are the floors, ceilings, and walls all intact? What exactly is included in the sale? Try your best to get estimates for these things when evaluating the actual cost of your investment. Not sure where to look? Many groups on Facebook and WhatsApp can help point you in the right direction.

⛔ Furniture:

If the place is not furnished, account for Furniture costs. To give a ballpark estimate: put aside $30k for a 2-bedroom condo. Some of these investments may be deductible from your capital gains tax as well.

7. Reduce Your Capital Gains Taxes from the Start

If you are a Mexican fiscal resident, the price of your property does not exceed a certain amount, you haven’t exempted anything in the past 3 years, and/or the nature of your transaction is inheritance or legacy, you could be exempt from a portion of your capital gains tax. Because many foreign investors do not meet this criteria, the biggest hope in reducing the amount you’ll be required to pay is through deductions. One thing you can do to increase deductions from the total amount due is to furnish strategically.

In PV, 74% of condos sold in the past 3 years that were not in the pre-construction phase – were sold furnished. The prominence of long-distance real estate investing and customizing furniture for a specific unit among other things have created this trend in Puerto Vallarta. However, many times it barely impacts the price of the property as it has come to be a general market expectation for buyers. To top it off, when it comes time to close on the sale of your furnished unit, the investment in the furniture is not deductible from your Capital Gains Tax. This is unless the furniture is considered a permanent fixture. This means, installing anything and everything you can.

Of course, hiring a carpenter to install a Murphy bed is a bit more involved than ordering a bed online and having it delivered, and it will cost you a bit more upfront. But if that investment can be deducted from your capital gains tax when it comes time to sell, then it’s probably worth the extra effort. Not to mention it also increases the value of your property.

8. Timing is Everything when it Comes to Listing your Property

The biggest fear in resale is often selling too soon and missing out on some huge gains, especially in a place like Puerto Vallarta where the rate of appreciation currently presents a great opportunity to see some substantial returns. However, if you’re ready to let it go, just make sure to thoroughly estimate your net gains prior to listing your property.

Only a notary can give you the exact details of your potential capital gains tax, but to get a ballpark amount, account for Capital gains tax at 5% of your listing price, and Commissions at about 10%. (8% commission + 16% IVA tax). With the 10% transaction costs you may have paid while purchasing the property and the aforementioned additional 15% or more of closing costs, that’s a big chunk of change associated with the cost of the transactions.

If you want to see any gain – or just hope not to lose money on the transactions – make sure to have a real estate agent perform a detailed Comparative Market Analysis (CMA) prior to listing. Unless the CMA reveals your property has appreciated by at least 50% of your initial purchase price, do not list it. So if you bought it at $300k, do not resell until the market indicates it is worth at least $450k. This means before any property purchase, you should be willing to sit on it for the length of time the appreciation rate of the region may indicate. That is, unless your rental income will potentially offset any capital loss, and you’re comfortable with that.

Considering an Investment Property in Puerto Vallarta, Mexico?

I am happy to answer any of your questions about buying, selling and /or living in Puerto Vallarta, Mexico. If you are interested in long-distance investment, we will facilitate the purchase and resale of your property, and oversee the ongoing property management with or without your physical presence in Mexico. We also provide detailed financial assessments, which include an estimate of costs associated with buying and selling, an annual report of ongoing overhead expenses to expect and potential rental income projections where applicable.

About Dyani Leal

Dyani Leal’s upbeat energy and life experience brings a unique perspective to her clients in Puerto Vallarta. Originally from the United States, Dyani embarked on an expatriate journey to Latin America in 2008. After spending a decade in Nicaragua, she now resides in Puerto Vallarta with her loving husband and two children.

Born in New York City and raised in Philadelphia, Dyani brings a wealth of insight into urban economies and market dynamics. Her fluency in Spanish and deep understanding of Latin American culture further enhance her cross-cultural acumen. Drawing on these perspectives, Dyani offers sound consultation on investment opportunities and invaluable insights into the local housing market.

As a member of AMPI, the regulatory body for Mexico’s real estate practice, and affiliated associations in the US and Canada, including the National Association for Realtors and CREA, Dyani ensures the highest professional standards in her work.

Whether clients are looking to sell their property, relocate to Mexico, purchase a vacation home, or identify a profitable investment opportunity, Dyani is a trusted and authentic advisor, guiding them toward achieving their desired outcomes.